The Child Tax Credit Guide For Us Expat Parents Bright Tax

The American Rescue Plan Act expands the child tax credit for tax year 2021. In 2021 Bidens stimulus plan increased the credit from 2000 per child to 3000 per child or 3600 per..

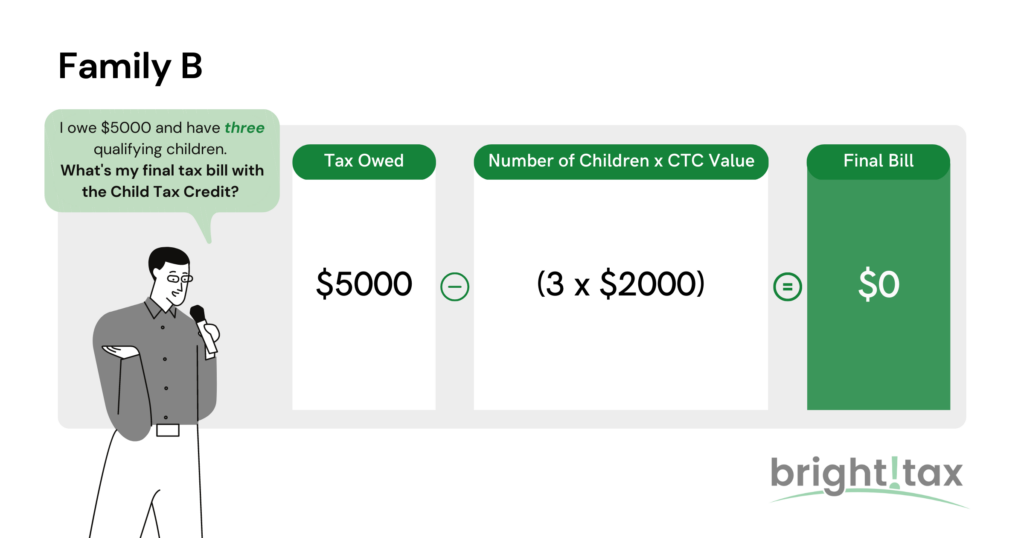

Claim a Qualifying Child with a Disability The qualifying child you claim for the EITC can be any age if they Have a permanent and total disability and. You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200000 400000 if. The child tax credit is worth up to 2000 per qualifying dependent under the age of 17 The credit is nonrefundable but some taxpayers may be eligible for a partial refund of up to. Child Tax Credit family element. Up to 3905 on top of the child element For each severely disabled child..

The Anti Poverty Targeting And Labor Supply Effects Of The Proposed Child Tax Credit Expansion Bfi

A bipartisan tax deal aims to expand the child tax credit and restore business deductions for tax year 2023 Increase the threshold to 1000 from. Congressional negotiators announced a roughly 80 billion deal on Tuesday to expand the federal child tax credit that if it becomes law would. Increased to 3600 from 1400 thanks to the American Rescue Plan 3600 for their child under. The current refundable tax credit is capped at 1600 per child and this deal would increase it incrementally and adjust it for inflation starting next. Parents can claim up to 2000 in tax benefits through the CTC for each child under 17 years old The tax credit is based on income requiring..

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to 3600 for children ages 5 and under at the end of 2021. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250. You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual. WASHINGTON The Internal Revenue Service today updated frequently asked questions FAQs for the 2021 Child. The Child Tax Credit is a fully refundable tax credit for families with qualifying children The American Rescue Plan expanded the Child Tax..

Komentar